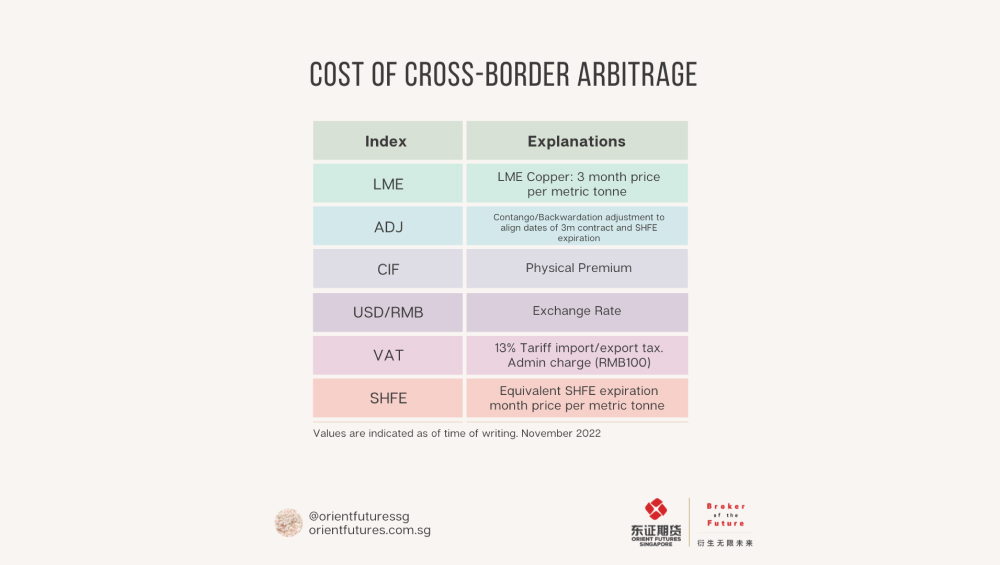

The cost of cross-border arbitrage is defined as the following:

[(LME +/- ADJ +CIF) * USD/RMB*(1+VAT) *(1+TARIFF) + ADMIN] – SHFE = arbitrage level

For this example, the arbitrage level is mainly affected by exchange rates, import duty, and price fluctuation. When the exchange rate fluctuates rapidly it may change buying power of domestic currency and importing costs.

Apart from these values, it is important to monitor the perimeters adjustment of different products as each of them will have a different indicator. Focussing on such details will be conducive to obtaining more accurate information while offering the lowest arbitrage cost.

Overall, paying attention to the cost calculation and key ratios will increase arbitrage opportunities and risk-free arbitrage profits.

Other forms of Arbitrage calculators can be found here.

Fundamental

A fundamental is an arbitrage philosophy based on specific events. Alternatively, the fundamental analysis is the process of determining the model price of a futures contract, now and in the future, using factors like microeconomic data, macroeconomic data, and industry financial conditions.

This is one of the factors that are integral to the arbitrage strategy, but there are many other factors.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.